Westpac’s vision out of its headquarters in Kent Street Sydney is to help its shareholders and pedophiles prosper and grow. The bank believes that helping certain communities – illegal migrant workers, ‘cash-onry’ ethnics evading tax, jihadi sympathisers, and pedo rings – is its responsibility as a global corporate citizen.

That’s why like the other global banks, it celebrates Chinese New Year yet shuns Australia Day. Try finding the Flag of Australia flying in any bank in Australia on January 26, any year. Leftie social responsibility departments have hatefully cursed it like Her Majesty The Queen’s portrait, in treacherous allegiance to yellow world domination.

The ‘global corporate citizen’ crap is parroting more anarcho-leftie anti-Australian globalist agenda. Banks like Westpac are all too ready to foreclose on Aussie farmers and small businesses doing it tough under imposed globalism. Yet, hypocritically they back dodgy foreigners.

This week Australia’s financial crime watchdog AUSTRAC accused Westpac of 23 million breaches of anti-money laundering rules between 2013 and 2018, claiming the bank facilitated offshore payments by ethnics to dodgy sh&thole countries and by convicted pedos, jihadists and foreign money launderers. Westpac set up its low-cost “LitePay” (LiteCoin) system to copy the likes of Western Union and Moneygram and others to attract the sh&thole demographic laundering cash from Australia to offshore.

AUSTRAC’s court filing this week states that Westpac contravened the anti money-laundering and Counter-Terrorism Financing Act (AML/CTF) on more than 23 million occasions. AUSTRAC claims that Westpac maintained relationships with offshore banks without assessing their business relationships, products, customers or payments, even when those banks disclosed relationships with “high risk or sanctioned countries including Iraq, Lebanon, Ukraine, Zimbabwe, and Democratic Republic of Congo” – aka sh&thole countries.

Cebu, Philippine’s pedo mecca

Cebu, Philippine’s pedo mecca

Bankrolling pedophiles, facilitating massive money-laundering schemes and terrorist-financing have branded Westpac, deservingly, an instant pariah of the banking world. One customer who had served a prison sentence for child exploitation set up several Westpac accounts. The pedo was full-blown addicted. Westpac detected suspicious activity in one account, but failed to review the other accounts and “this customer continued to send frequent low value payments to the Philippines through channels that were not being monitored appropriately”, AUSTRAC said.

AUSTRAC noted LitePay was launched as part of Canberra’s globalist initiative to experiment with Australian taxpayer wealth and gamble with cryptocurrencies, claiming it would so somehow…“improve the livelihoods of men and women in the Pacific”.

Canberra eh? Whatever happened to Julia Gillard’s $320 million treasury misappropriation when she was PM, supposedly to promote gender equality in the Pacific? UN socialist wealth re-distribution or what? Wouldn’t sending condoms to these Third World überbreeders be more humanitarian?

Attorney-General Christian Porter reckons Westpac should expect an AUSTRAC fine “well over” the $700 million imposed on the Commonwealth Bank last year for more than 53,000 breaches of anti-money laundering and counter-terrorism laws.

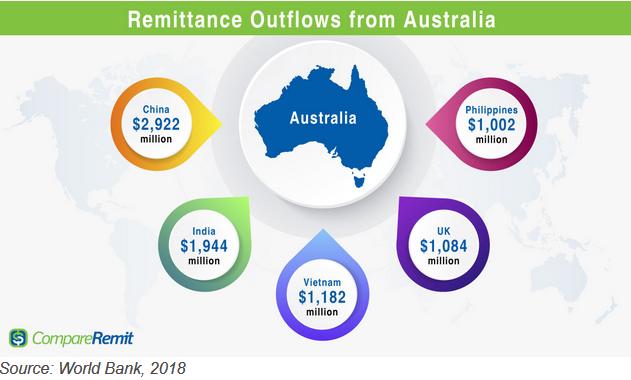

In Australia members of expatriate communities (aka ethnics) with connections to their home countries have been encouraged to establish accounts with the likes of lower-cost remittance services, like LitePay. Chinese Indians and Vietnemese are right on to it – to evade paying Australian tax of course.

Dodgy ethnics exploit the likes of LitePay, Western Union, Moneygram,TransferWise, Remitly, Remit2India (a curry muncher favourite), Rocket Remit, Flyworld, WorldRemit, InstaRem and others to money launder their cash offshore.

Thousands of ethnic cash-onry small businesses (like noodle shops) facilitate the transfer of small amounts to back home in motherland, and low costs – generally less than A$500 a month. They do so using lower-cost remittance services accounts with banks like Westpac’s LitePay.

Australia census of 2018 recorded that out of 25.20 million population in Australia, 2.4% are Indians by the country of birth. It is no surprise that the number of people sending money online from Australia to India is significant; Chinese are worse.

In 2013, Australian banks joined a global trend to “de-bank” small remitters, due to money-laundering and terrorist-financing risks. Over the next few years the accounts of more than 700 small Australian remitters, many of which were AUSTRAC-registered, were closed. Westpac was the last of Australia’s big four banks to withdraw from servicing remitters.

AUSTRAC’s charges against Westpac outline 12 cases involving repeated suspicious payments to the Philippines using LitePay. The money transfers matched known child-exploitation transaction patterns. Westpac failed to identify and report these prior to 2018 because it lacked appropriate detection measures for those transaction patterns. Did it really care?

Westpac chief executive Brian Hartzer says it was an oversight and he’s stepping down by Christmas with a with $2.68 million ‘Don’t-Come-Monday‘ redundancy. The bank’s chairman, Lindsay Maxted, reckons he’s to bring forward his own retirement to the first half of 2020.

Hartzer: “the average Australian wouldn’t consider Westpac’s woes a major issue.”

It gets worse, read more.

The Hayne Royal Commission that PM Scomo reckoned wasn’t necessary, hasn’t been the end of the drama for the greedy big four banks, despite what some might characterise as a toothless government response.

How much Australian money has made it to Syria and Iraq to fund nutjob Islamism?

Even more troublingly, the regulator says Westpac through its cheap and slack low-value international payments service ‘LitePay’ and so facilitate child exploitation by allowing pedo rings in southeast Asia (especially the Philippines) with bugger all oversight.

According to AUSTRAC, Westpac knew there were heightened child exploitation risks with frequent low-value payments to certain areas in the Philippines and other parts of southeast Asia. However, the bank did not implement a proper automated detection solution until 2018.

It’s this last allegation which is dominating headlines, with Home Affairs Minister Peter Dutton alleging Westpac has “given a free pass to pedophiles” and should face significant consequences. “It is clear… that the Westpac banking bosses, through their negligence, have given a free pass to pedophiles, and there is a price to pay for that and that price will be paid and we have been very clear about it,” Minister Dutton told Parliament this week.

The AUSTRAC lawsuit comes as Australia’s retail banking system seeks to rebuild its reputation after a stinging a public inquiry found it had a culture of widespread profiteering, customer fee-gouging and slipshod regulatory oversight.

Back in February 2019, failed Labor Premier Anna Bligh, as recruited spin doctor for the banks reckoned the Hayne Royal Commission into banking corruption and dodginess, reckoned the banks had to accept full responsibility and know that they must now change to ensure the dodginess never happens again. Famous last words.

Bligh: “The industry understands that many people are cynical about whether banks will really change, but don’t judge us by our words, judge us by our actions.”

Part of the slippery slope of Canberra’s sheltered workshop