Last month, Sydney’s prominent real estate agent entrepreneur John McGrath recognised that Sydney market’s growth rate was “unsustainable” and was at risk of “overheating”.

Mr McGrath, the chief executive of McGrath Estate Agents, said the Sydney market was “hot, hot”, citing auction clearance rates above 80 per cent over the past three months. “I haven’t seen it this hot since the last real estate boom,” he told a mortgage brokers conference in Sydney.

“Home prices in Sydney are being pushed up in part by unprecedented levels of Chinese demand. The Chinese market is extremely strong, the strongest I’ve seen a new entrant into the market. As much as 80 per cent of homes in parts of Sydney are being sold to Chinese buyers,” said chief executive John McGrath.

Chinese buyers, facing government restrictions on purchases at home, were the third-biggest source of foreign investment in Australian real estate, behind the US and Singapore in fiscal year 2012, the latest figures from the Foreign Investment Review Board showed. They accounted for $4.2 billion of transactions, a 75 per cent jump from 2010, according to the data.

This is not foreign investment. It is foreign ownership and takeover of prime Australian real estate. Chinese invasion is out of control not just in our cities, but of Australia’s natural resources and agricultural land.

It is part of LibLab’s selling the farm that we call “Vaseline Diplomacy”.

Chinese are buying in (urban) Australia on expectations of capital growth, to provide a home for their children attending university in the country or simply to live outside China, Mr McGrath said.

It means Australia’s urban children will have to go bush to live and study to make room for the hoards of wealthy immigrant Chinese.

We say thank you to Mr McGrath for publicly divulging the unsavoury truth of LibLab urban policy.

Sydney property prices rose 6.7 per cent in 2012-13 and 2.7 per cent in the three months ended June 30, according to Australian Property Monitors. Nationally, median capital city house prices rose 5.4 per cent over the financial year and 2.8 per cent in the last quarter. The auction clearance rate in Sydney hit a record of 82.5 per cent this month.

Melbourne’s 70 per cent rate is the highest since 2010.

Hundreds of thousands of wealthy Chinese immigrants have been invited into Australia’s capital cities with financial enticements by the Mandarin-luving Rudd Labor Party.

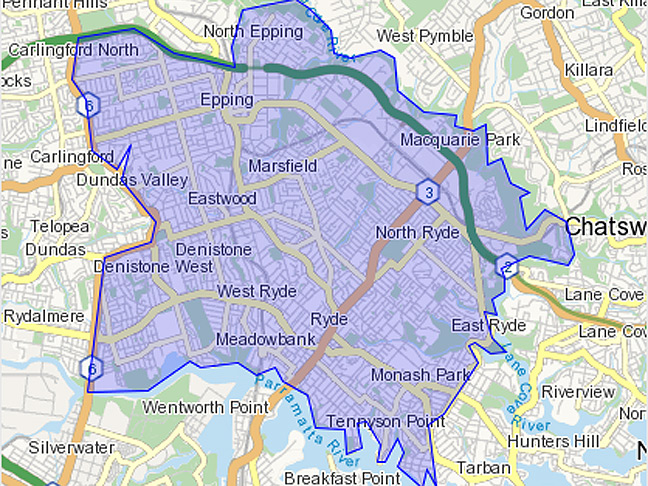

Sydney’s north west suburb of Eastwood has become favoured turf for the invading Chinese enclaving it within the federal seat of Chinese Bennelong. Chinese immigrants have swamped it to becoming 17 per cent of the population. So Rudd’s Foreign Labor parachuted in ethnic Chinese Jason Yat-sen Li as its candidate for the 2013 federal election.

Spot the Aussie here at the Eastwood auction.

Nice one Labor. Good betrayal of the dominant 83% Aussie majority!

The Greater Chinese Enclave of Bennelong.

At this recent property auction in Eastwood, all 38 of the registered bidders were of Asian ethnic origin, Mr McGrath said. The three-bedroom house with a double lock-up garage and two sun rooms opening on to the back yard, sold for $2.39 million, more than $1 million over the reserve price, after 62 bids by eight hopeful buyers, according to the agent.

So this simple plain house in an average Sydney suburb of Eastwood sold for $2.385 million as desperate buyers keep blowing their budgets.

This modest 3-bedroom Eastwood home sold for $1 million above the fair reserve, for $2.39 million. Artificially over-priced at auction by hundreds of wealthy Asians locking out ordinary Australians from living in their own city.

Because of mass immigration jointly by Labor and Liberal parties, ordinary Australian families in our capital cities have seen their children forced out into distant regional area simply because immigrant demand has over-inflated and outpriced them of urban housing.

Invasion is bloody wrong!

Australian sovereignty erupted in 1861 when thousand odd Chinese overran Lambing Flat, and it can easily erupt again.