Chinese middle class investors are buying up almost one-fifth of new housing built in Sydney as part of a $5 billion annual outlay on Australian real estate which is pushing up prices and will ultimately change the way property values are calculated.

Chinese buyers now account for 18 per cent of new home purchases in New South Wales and 14 per cent of new dwelling supply in Victoria, research analysts at Credit Suisse have found.

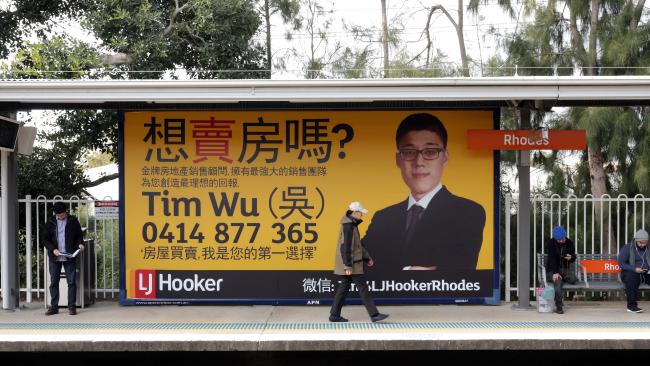

Spot the Aussie: They ignore the suit; she’s the one that speaks Chinese.

Spot the Aussie: They ignore the suit; she’s the one that speaks Chinese.

An estimated $5.4 billion is being spent each year on Australian residential property by a mix of Chinese new settlers, Chinese temporary residents, Chinese developers and Chinese investors, Credit Suisse analysts Hasan Tevfik and Damien Boey have said.

Already there are 1.1 million millionaires in China who “can easily afford to buy an apartment in, Sydney’s Chinese Chatswood – an upper-middle class area of Sydney,” the report said, and there will be 1.5 million by 2020.

“We forecast Chinese buying power will increase as the economy develops and the population becomes wealthier,” the analysts said. “They purchased $24 billion of Australian housing over the past seven years; we forecast they will purchase $44 billion over the next seven, to 2020.”

While Chinese purchases account for only 12 per cent of new housing supply each year on a national basis, buyers are concentrating on Sydney and Melbourne, with the result that house prices are rising faster than local incomes.

Citing international Demographia research that shows Sydney and Melbourne are the fourth and fifth most expensive big cities globally in terms of house price to income ratios, the Credit Suisse report said a generation of Australians is being priced out of the market.

“While the Chinese may not be a major player in the national housing market, they are clearly a much more powerful force in Sydney and Melbourne,” Credit Suisse said.

Sydney-centric Premier Mike Baird, luvs his Chinese

Sydney-centric Premier Mike Baird, luvs his Chinese

Sydney and Melbourne are now part of a global marketplace for Chinese investors who consider property in those cities alongside New York, Los Angeles, Vancouver and London.

In that marketplace, decisions are influenced by exchange rates and foreign investment policies; the report notes that Canada recently decided to end its Significant Investor Visa system, which was similar to the current Australian policy that gives preferential visa treatment to those investing $5 million or more in the country.

“The emergence of the global property investor means that valuation methods like house price to local income ratios are becoming obsolete,” the analysts said.

Credit Suisse warned that Sydney is likely to resemble London in the future, where well-paid investment bankers struggle to buy a house because wealthy individuals from the Middle East, Africa and Europe have bid up prices.

“And both the UK and Australia have their borders open to new immigrants, especially if they are rich,” it said.

While prospective home buyers might despair, the analysts suggest there is a way to benefit from the phenomenon by investing in the companies that stand to benefit from the increased Chinese interest: developers, building materials companies, property websites and banks.

Mirvac, Boral, CSR, National Australia Bank, REA Group and Fairfax Media were among those stocks named in the report, which also noted the possibility of a Chinese entity taking over an Australian developer.

Four ways Chinese investors can buy property in Australia:

- Chinese citizen or temporary resident buys new dwelling with Foreign Investment Review Board (FIRB) approval.

- Chinese citizen temporarily residing in Australia buys established house – only one dwelling allowed (includes Significant Investor Visa).

- Chinese citizen can buy residential property for redevelopment with FIRB approval. (FIRB always approves because it is currupt)

- Recent Chinese settler in Australia can buy property for investment or residential purposes. (FIRB apparently approval not needed for permanent residents).

Meanwhile, recently the Chinese took possession of a wheat farm near Hyden near Albany in Western Australia so it could export all wheat back to the Chinese in China.

Chinese Heilongjiang Feng Agricultural and Vicstock Grain, said they planned to double the size of their farming operations in southern WA to 100,000ha next year and would only get “bigger and better”.

The group’s farm manager Jim Hutchinson (a traitor) is responsible for 47,000ha over multiple farms owned or leased by HFA and Vicstock, which were backed by the Beidahuang Group. Mr Hutchinson said they were set to deliver a respectable two tonnes a hectare average on their wheat and barley crops, and about 1.3t/ha on canola crops.

HFA is also locked in a legal battle with Ian Tonkin and his wife Carolyn, who allege the company has failed to honour a contract signed two years ago to buy their farm for $8 million.

The Tonkin farm adjoins Connemara, the property at Lake Varley near Hyden where Mr Hutchinson is based. It was purchased through receivers after companies controlled by one of WA’s biggest grain growing families collapsed.

Beidahuang began scouting out Wheatbelt farms more than two years ago. HFA completed the purchases of three farms – for $29 million, $23.2 million and $18 million – in a five-month period to the end of March.

The farms, between Lake Varley and Ongerup, cover 36,500ha and the rest of the Chinese operations are leased. The companies also financed the operations of up to five cash-strapped farmers to secure grain from this harvest.

Vicstock secured a 16-year lease on land and storage shed at Albany Port in March but is now seeking to renegotiate the terms with the port authority.

HFA and Vicstock will rely on the CBH storage, handling and port facilities for this harvest. The companies had planned to begin bulk grain exports from Albany to China early next year after an initial $10 million upgrade of the storage shed and a woodchip loader.

Chinese are buying up vast tracts of Australian farmland, putting at peril Australia’s own food security.

In 2012, the former mayor of Richmond in central Queensland, John Wharton, was outspoken saying he is “dead against” allowing Chinese buyers to acquire local farms.

Similarly, Bob Katter has said, “I don’t mind the Chinese lending money to us for us to go out and buy the properties, but as far as the Chinese coming in and buying everything up, we are dead against the idea. “We can’t go and buy their land, so why should they be allowed to run amok here?”

Since Labor’s Rudd came to power in 2007, Chinese interest in Australian agricultural land has been intensifying, with about $500 million of intended investment planned ahead of the release of a key federal government report that will reveal the extent of foreign ownership in the sector.

A diverse group of Chinese delegates from private and state-owned companies met in Sydney just before Christmas 2012 with Austrade representatives, corporate advisers and industry heads, to discuss opportunities in rural Australia covering more than 100,000 hectares of prime land.

The Chinese delegation included three representatives from China’s Ministry of Commerce, which recently forecast that the country’s private companies and wealth funds would invest up to $560 billion overseas by 2015.

The presidents of companies such as Shandong Taifeng Textile Co Ltd and the Shanghai Xiangfu Real Estate Investment Co attended the private lunch in order to discuss their plans, ranging from a $25 million purchase of 20,000 hectares of cotton property to investing $US350 million in farmland in Western Australia and Queensland. Other major Chinese companies included in the discussions were the Bright Food (Group) Co, Shandong Ruyi Technology Group Co and Nanshan Group Co Ltd.

Documents seen by The Australian Financial Review, titled The China Food Security Study, reveals the Chinese companies were interested in investing more than $500 million in agricultural ventures ranging from dairy farming and ultra-fine wool production to animal husbandry and frozen vegetables. One of the documents indicates that the Nanshan Group, ranked 188 in the top 500 enterprises of China, is intending to secure four properties with an area of about 30,000 hectares in NSW and Tasmania for the production of superfine wool.

Another Chinese government-backed company, Shaanxi Kingbull Livestock Co, is intending to buy a 5000 hectare cattle station in Australia as a stepping stone to importing 10,000 high-quality beef cattle and calves from Australia each year.

The meeting between delegates and Australian corporate and industry representatives was arranged by Austrade and the Department of Foreign Affairs and Trade.

Meeting at the Marigold restaurant in Sydney’s Chinatown, several interpreters were seated with the investors and helped facilitate introductions and discussions.

The meeting comes just as the federal government is due to receive a review of foreign investment in rural land, by the Australian Bureau of Agricultural and Resource Economics (ABARE) and the Rural Industries Research and Development Corporation. The review was commissioned more than a year ago amid rising debate about foreign investment. The first part of research by the Australian Bureau of Statistics was released last September and showed that 99 per cent of Australian agricultural businesses were owned by Australians.

The ABS data showed 5.8 per cent of agricultural land was foreign owned and 5.5 per cent was majority owned by Australians with some foreign involvement. Releasing the ABS figures, former assistant treasurer Bill Shorten said: “As a capital-importing country, foreign investment is crucial to ensuring our continued economic growth and prosperity – including in the agriculture sector.

“However, foreign investment is changing around the world. It is vital we protect the national interest and continue to strike the right balance between attracting foreign investment and ensuring Australia’s agricultural sector and food security are maintained.” The issue of foreign purchases of agricultural land has been a hot topic because of the threat of overseas government-backed enterprises outcompeting domestic private companies on land purchases for the sake of food security.

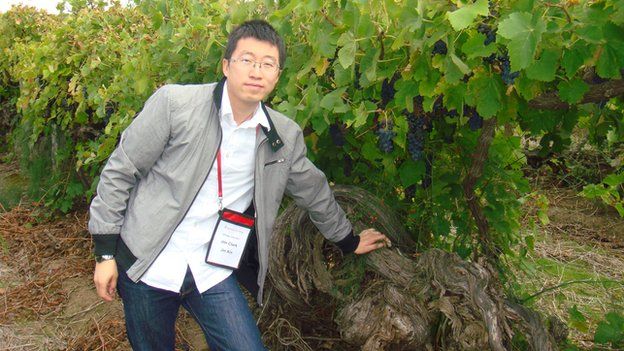

Patrick is not his real name. Try Xubo.

Patrick is not his real name. Try Xubo.

In 2012, the Chinese government-owned COFCO, led by president Patrick Yu, took control of Tully Sugar, one of the last major sugar assets in Australia, for $136 million. Several prime agricultural properties such as the well-known Bobbara Station, west of Yass, NSW, and the Upper Murray’s famous Mt Falcon Station have also recently been sold to Chinese buyers – but names and details of the buyers have so far been withheld from the public. There have been concerns raised about the secretive nature of foreign purchases of rural land, and the lack of transparency on ownership details.

Xubo Yu (49) is a Hong Kong multi-millionaire and life member of the Chinese Communist Party CPC). He has coprorate board links with the following multinationals:

- COFCO Corporation

- China Mengniu Dairy Co. Ltd.

- China Foods Limited

- Huazhang Gong

- China Southern Airlines Co. Ltd.

- Joy City Property Limited

- Southern Capital Group

- Noble Group Limited

- Hysan Development Company Limited

- Indochina Capital Corporation

- PureCircle Limited

- KCS Corporate Services Pte Ltd

- United Overseas Bank Limited

- Total E-Commerce Ltd

- Samsonite International S.A.

- Inner Mongolia Mengniu Dairy (Group) Company Limited

- China Power International Development Ltd

- China Mengniu Dairy Co. Ltd

- Top Glory International Holdings Ltd

- CDH Investments

- HOPU Jinghua (Beijing) Investment Consultancy Co., Ltd

- Arla Foods amba

- 361 Degrees International Limited

- SPT Energy Group Inc

- China Agri-Industries Holdings Limited

- Rabobank International

- Genting Hong Kong Limited

- Tibet 5100 Water Resources Holdings Ltd

- China Modern Dairy Holdings Ltd.

In 2011, the New Zealand government introduced new laws requiring government approval for land purchases greater than five hectares and taking account of whether “economic interests” had been safeguarded. In Australia, the current rules require foreign investors to obtain federal government approval only when purchases cost more than $231 million.

In central Queensland, cattle station owner and Richmond Mayor John Wharton said he was “dead against” unabated Chinese buying- up of rural land.

“I don’t mind the Chinese lending money to us for us to go out and buy the properties, but as far as the Chinese coming in and buying everything up, we are dead against that idea,” he said.

“We can’t go and buy their land, so why should they be allowed to run amok here?”

He says that at the very least there should be some cap on how much the Chinese can buy and that there should be a register.

But Labor and Liberal trade ministers respectively claim that foreign ownership of our agriculture is beneficial because it links wealthy Australian exporters to global export markets – Bob Hawkie’s’ quid pro quo.