This Blue Paper is a draft prescriptive standard for Australianness, arising out of multiple challenges to Australian values by foreign influences, by anti-Australian sentiment and by our governments kowtowing to unethical and backward cultures that are undermining Australian traditional values. This is a feeder document toward nationalist policy and subsequent draft proposed law, inviting input and debate by Australians.

Nationalist Initiatives

Nationalised Primary Services

- Nationalise Health, Hospitals, Mental Health and Aged Care

- Nationalise Education from Child Care to Trade and Tertiary

- Nationalise Transport of both passenger and freight

- Nationalise Telecommunications – phone, mobile, Internet services (Telstra to be re-acquired as a critical public asset by the national government)

Inalienable National Critical Assets

- Critical assets vital for the survival and operation of the nation to be nationalised, acquisition from the private sector to be phased over two decades, asset pricing to be set by a dedicated national commission

- Such assets include coal mining and coal transport, energy generation, energy distribution, oil drilling, petrol and diesel refining and distribution, petrol drilling and diesel fuel, passenger and freight rail, roads and bridges, telecommunications, central bank including trading, merchant banking and retail banking, hospitals, ports, critical civil infrastructure, etc.

- Retail pricing of critical utilities to be centrally controlled by the national government.

Inalienable Citizens Retirement Fund

Australian Citizens deserve a decent retirement after a lifetime of work, after rearing young Australians, after service to their country and after paying taxes to government throughout their working lives.

Political parties that don’t give a crock about this, don’t deserve Australian votes.

For those few Australians who are lucky enough through life circumstances to self-fund their retirement and so live well and a full life in their retirement, good luck to them. In our lucky country, such reward ought to be more mainstream.

But to more than 2 million retired Australians currently receiving the derogatory ‘aged pension‘ from the Australian Government, including Australia’s aged service veterans, the pittance handed out by current LibLab governments is just $23,000 a year for those on their own, or just $18,000 a year for those still living with their partner.

Since 1992 under Paul Keating, the Australian government (Labor and Liberal), have shirked national responsibility for funding older Australian Citizens in their retirement. Keating in 1992, compelled Australian businesses to pay compulsory superannuation to private corporate funds for each employee.

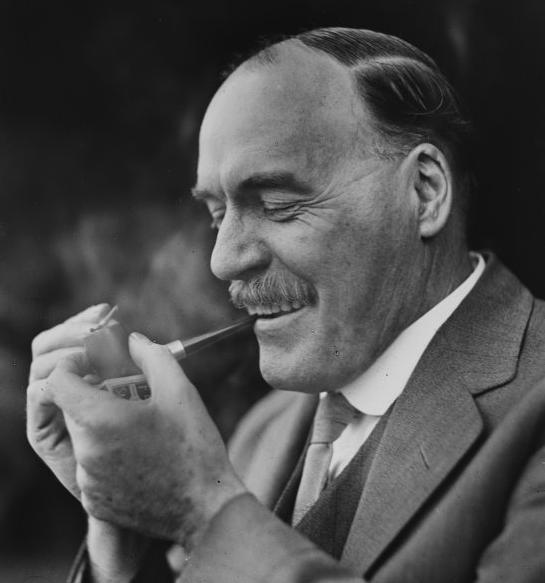

Self-serving Git

Keating’s Compulsory Superannuation was a cop out scheme for Labor to rob billions from Australians’ wealth fund set aside to provide for Australians in their retirement. Typical Labor!

Labor’s spending addiction drove it to steal from retirees in order to fund Labor’s extravagant habit and lifestyle. It illegitimately used retiree money for its own purpose.

Nothing’s changed. Indeed, Rudd has perpetuated Keating exponentially.

Keating’s Compulsory Superannuation scheme was culturally sexist – lesser-earning women, particularly mothers taking time out from the workplace, would earn less and so receive less employer super and so retire on less – than males on longer, larger salaries. It was to be expected, so sexist. It is slave driving – work long, retire on more. Work less, retire on less. So the Keating Government was only about avoiding government responsibility to fund taxpayer retirement. Selfish bastards the lot!

It unfairly added an employee cost burden of 9% upon Australian businesses, because instead of the government properly funding pensions, employers were now required to. This 9% cost impost came at a time when Labor also opened up Australian retail to cheap import dumping. Keating’s Button Plan was the beginning of the end for Australian industry, manufacturing and decent workplace wages.

No decent economy can begin to compete with Turd World two bit wages like the tragic slaves of Savar in Bangladesh.

The compulsory superannuation funds have been channelled to private and foreign corporations and financial planners, in which millions have been extracted in commissions.

The trillion or so in compulsory superannuation funds nationally belonging to Australians for their retirement is not guaranteed but subject to investment risk and many funds have shrunk from massive valuation losses fromn stick market gambling.

Keating and successive givernments don’t care. They have rubbedd their hands of the responsibility of providing for decent retirement of Australian Citizens. That trillion should have been Australian Government guarranteed funds to provide for decent pensions to Australia’s retirees. Not the $20,000 poverty level, but the minimum wage level.

The 2013 minimum wage is $32,000 a year.

Legitimate government must support its citizens, for any power that does not becomes democratically illegitimate instantly. Since 1992, both Labor and Liberal governments perpetuating Keating’s Pension Theft have been illegitimate.

Australia First Party demands that the Australian Government takes full responsibility for funding and delivery of a decent aged pension to all Australian Citizens on a fair and reasonable revenue means-tested basis.

Cut Parliamentary Pensions – a model for a new National Pensions Bill

Kevin Rudd will receive more than $600,000 a year for the rest of his life once he leaves politics, because his fellow politicians passed self-serving legislation to dictate it.

Hundreds of other politicians in Australia at state and federal level are reaping unearned aristocratic-level indexed pensions for life after they have stopped serving the Australian people.

The combined millions forked out for Gentlemen Jim and Lady Muck lifestyles is paid for out of the taxes of the hardworking commoner,’ otherwise known as ‘Australian Taxpayers’.

Parliamentary self-serving till pinching is an undemocratic rort that imposes a burden upon future Australian workers to compulsorily pay for a past polly alumni. Parliamentary Pensions discriminate in favour of the privileged few politicians in our society who chose to abuse their power by legislating unilaterally to line their own pockets on exiting politics, whether they leave us in a mess or not. It is undemocratically unconscionable, and it this polly rort has got to stop.

Why should politicians be any different to ordinary Australians once they retire from their elected public duty as public servants? They shouldn’t. They are not royalty. Australians democratically rejected royalty as head of state in our 1900 referendum preceding Federation in 1901.

Australia’s retired politicians automatically return to being ordinary Australian citizens, never God-given aristocrats.

As with K Rudd, Australian politicians have not only gifted themselves generous pensions for life after politics, they receive bonus superannuation and a gold air pass so they can fly business class 40 times a year on future taxpayers’ tab for the rest of their life.

Ex-prime ministers also somehow get a new luxury car upgraded every 3 years, at least four personal staff costing $240,000 a year, and their own CBD office space in an Australian capital city of their choice costing $120,000 a year. Former Australian PMs Gillard, Howard, Keating, Hawke, Fraser and Whitlam all got these perks, paid for by Australian taxes, unearned like leeching aristocrats.

Rudd stands to siphon perhaps $20 million worth of allowances from future Australian workers if he lives to 85. This is despite the fact he served around three years as Prime Minister.

Australia First Party recognises that for Australia to attract and retain the best leaders to serve the Australian public interest either as politicians or as executive departmental public servants, their remuneration while in office needs to be raised to be commensurate with the competitive senior executive rates earned in private corporate sector.

But upon public duty ending, entitlement to the public purse ends with it. Retirement, in the true Australian spirit of being a classless society, must be uniform amongst all Australians. To be fairly distributed, pensions need to be means tested against taxable income.

Retirement Wealth Fund

Posit for a social urgency for true reform to respect and honour the decency of Australian Citizens in their Retirement:

- A Retirement Wealth Fund to replace the Australian Aged Pension and which shall apply to all Australian Citizens only from age 65

- Compulsory Superannuation Guarantee payable by employers to be scrapped

- Compulsory Super to be replaced with a new ‘Retirement Wealth Fund‘.

- Retirement Wealth Fund to be funded by a mix of national government secure investments controlled by a reconfigured APRA renamed and from tax revenue from revenues earned by foreign-owned corporations operating in Australia, a national lottery (all private lotteries to be acquired by the national government), redirection of Australia’s foreign budget, and from various ‘user pays’ taxes on public infrastructure usage – i.e. motorway tolls, increased departure tax, import tax duty on imports, a premium tax on imported luxury goods.

- Entitlement to the ‘Retirement Wealth Fund‘ to be accessible by Australian Citizens only living in Australia from age 60 and subject to a sliding means test scale on the basis of income, not asset wealth

- The Australian Government to transfer all superannuation funds out of private corporations into a new National Wealth Fund completely controlled by the Australian Government as a national public asset and solely to fund Australian Citizens (only) in their retirement.

- The transfer of superannuation funds to be flexible to allowing the repayments of personal mortgages on principal residences only.

- Australian aged pensions to be controlled and administered by a new nationally dedicated Retirement Wealth Fund perpetually guaranteed by the Australian Government never exposed to the whims, vagaries and manipulations of stock markets and foreign interests.

- Australian retirement pensions to be paid only to Australian Citizens aged 60 and over, and paid weekly at the same rate as the minimum wage (currently $32,000 p.a.).

- Revenue means testing to apply and to be fairly determined.

- Repeal all legislation that enables any parliamentarian or public servant under any jurisdiction within Australia and its territories to receive any Australian taxpayer funded financial benefits above a Retirement Pension, once leaving public office

- All privileged financial extras such as bonus superannuation, gold air passes, cars, offices, etc, shall be abolished

- The pension shall be means tested on a sliding scale according to annual household taxable income as defined by the Australian Parliament; not upon one’s asset wealth

- Australian Citizens residing outside Australia shall not be entitled to a Retirement Pension for the portion of the financial tax year they reside outside Australia.

Supportive Precepts Linked to Evidence

Australia First Party’s vision is to restore Australia to its traditional classless society in the spirit of Jack Lang’s honest nationalist Australianism.