What’s the bet Mal’s left testicle Scomo, comes out of hiding today puffing his chest from the Tax Office’s $300 million court win against multinational Chevron?

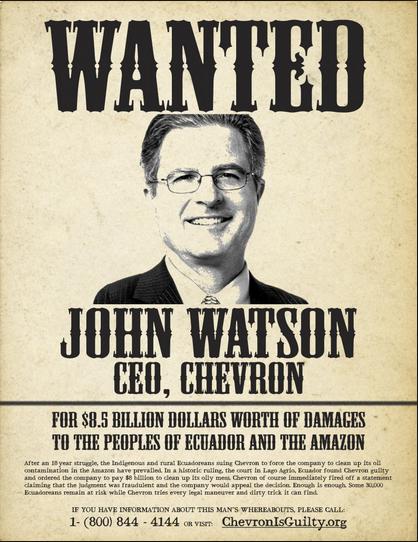

US oil multinational Chevron is one of many foreign and multinational corporations that deceptively avoid paying billions in tax owned to the Australian government, which means to fund our public services, etc. Today, Australia’s Federal Court made a landmark ruling against transfer pricing, disallowing offshore profit shifting by the multinational to avoid tax. Transfer pricing provisions are designed to stop the domestic revenue base being eroded by the cost of cross-border acquisitions between related parties.

Today’s Tax Office win means Chevron loses its court appeal and so has to pay its tax bill owed of more than $300 million plus its legal costs and the tax offices costs.

That’ll help pay down Labor’s debt. That is unless Labor-lite Mal finds another costly innovation to pull out of his hat. Australia’s national public sector debt has only got worse under Abbott and Turnbull. Rudd-Gillard-Rudd racked up $200+ billion. Now its $700 billion.

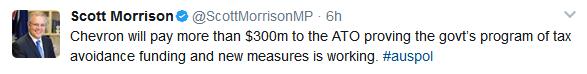

Mal’s sycophant Treasurer, Scott Morrison, is set to take full credit for what he tries to won as his personal policy of cracking down on multinational tax avoidance. In last May’s Budget, Scomo, declared 390 new Tax Office staff (contractors) would be added to his new “tax avoidance taskforce” with “extra powers” to investigate and penalise multinationals that divert profits offshore.

Yeah yeah yeah. The multinationals have been doing it for decades, and only now you act?

But this ‘crackdown’ was to reverse the Liberal-Nationals 4700 sackings of Tax Office staff since they came to government in 2013, and so an admission of false economy. Less tax staff equals less tax chasing Scotty boy.

So Scomo will be all pleased with his first big scalp in Chevron. Yet the $300 million is only a fraction of what Chevron has avoided in tax. It could still appeal and Scomo’ tax avoidance laws are still slack.

Chevron used an intra-company loan as a means of shifting millions in profits offshore to avoid tax on its Australian income. Labor when in government back in 2009 was all “jobs, jobs, jobs” and taxes and royalties when it approved Chevron the Gorgon offshore oil and gas drilling project off the Pilbara coast in Western Australia. The Liberals in WA also championed the Gorgon Project. Chevron has been rorting billions ever since back to its tax haven in the United States. Chevron dodgied its accounts using deductions for a 7.8% interest difference it claimed on internal loans between its parent and Australian subsidiary. And that is just one loan. There are much bigger loans happening. There are also hundreds of multinationals doing transfer pricing.

“This an important victory for the ATO and the Australian people,” Jason Ward from the Tax Justice Network, Australia, said after the ruling. “It sends a clear message to Chevron and other multinationals that these tax dodging schemes won’t be allowed any longer.”

Mr Ward said the decision “should have immediate implications” for Chevron’s much larger $42 billion loan, to fund development of its north west shelf gas facilities, which involved a similar internal debt financing, albeit with a far lower interest rate charged.

Transfer pricing is not a new thing. It’s just that Australia’s tax law lets multinationals get away with it and so avoid tax. Both Labor and the Libs in bed with the Nats have all written the tax laws. Many of their alumni end up working for these multinationals anyway, or like union boss Paul Howes, with accounting firms like KPMG to show their multinational clients how to play the system.

Postscript:

Told ya…