Aussies are better off accepting cash for work wherever possible to avoid paying tax. Tax only encourages the Liberal or Labor governments wasting our taxes on dumb useless pet projects, like funding Abbott’s F35s, and Bob Brown’s Chinese wind farms.

Why should Ordinary Australians pay tax when many wealthy multinationals don’t pay tax?

The Tax Office has revealed that over the past year, more than 1,500 big corporates with annual incomes of more than $100 million, didn’t pay they fair share of tax. The tax commissioner says in 2013-14, 579 companies in Australia did not pay any tax at all, despite making many hundreds of million is sales in Australia. Basically they use clever accounting loopholes to shift profits offshore to tax havens and low tax countries.

For example, Immigration detention centre manager Transfield paid no tax in 2013-14. Cleaning company Spotless Group, which underpays its staff, made about $2.2 billion, but paid no tax. Qantas, Virgin Australia, General Motors (owner of Holden), Vodafone, ExxonMobil, online betting shop William Hill, Warner Bros Entertainment, property developer Lend Lease and media company Ten Network Holdings all did not pay any tax to the Australian government in 2013-14.

So why should hard-working Ordinary Australians?

So accept cash for jobs and don’t declare the income. Ordinary Aussies don’t have access to the pinstriped dodgy accountants setting up tax evasion schemes and offshore profit shifting. So for the rest of us, the easiest option is to just accept cash for jobs and not to declare it to Canberra.

Volkswagen made almost $2 billion in 2013-14. But, its taxable income was $35 million and it only paid $10 million. Yokohama Tyres Australia paid about $220,000 tax on a taxable income of $747,000, despite earning $121 million.

US technology giant Apple had total income of about $6.1 billion, but only $247 million of that was taxable income. US technology giant Microsoft had taxable income close to $104 million, less than a fifth of its total revenue of $568 million. Its tax bill was about $31 million — just 5 per cent of its income. Google’s total income was about $358 million, but only a quarter of that was taxable. Google’s tax bill was $9 million.

Google’s CEO Sundar Pichai (a Tamil from India) is on US$200 million a year, thanks

Google’s CEO Sundar Pichai (a Tamil from India) is on US$200 million a year, thanks

Don’t believe it? Read More: http://www.managementtoday.co.uk/news/1382759/google-boss-sundar-pichais-salary-hits-200m/

The Liberal Party gets massive donations from big corporates, so it is corruptly letting their big end of town mates get away with it. In 2014, Google gave $60,000 apiece to the Chifley and Menzies Research Centres, associated with the Labor and Liberal parties respectively. Total donations to the Libs in 2014 (notably a non-election year) was $125 million from the big end of town.

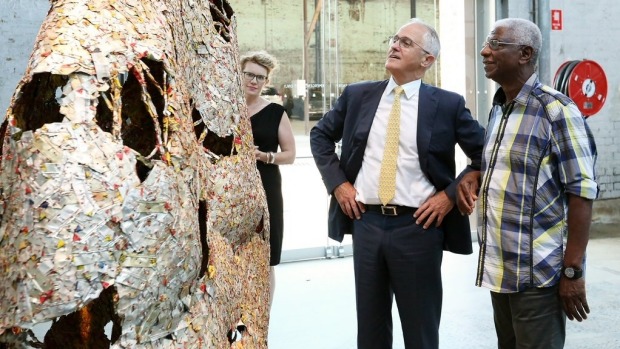

At the same time, Turncoat Turnbull today announces he’s keeping Gillard Green’s $1 billion Clean Energy Innovation Fund (CEIF) from 2012 and what has been dubbed ‘Bob Brown’s Bank‘, Gillard’s $10 billion Clean Energy Finance Corporation. Brown was then part of the Australian Conservation Foundation which conjured up the idea for the then Gillard-Greens coalition.

It just keeps reinforcing the fact that there is no ideological difference between the Greens, Labor and the Libs. The Nats exist as Liberal Party lapdogs to do the Liberal’s rural mining bidding.

How much do you want for this one cob?

How much do you want for this one cob?

PM Turnbull says his innovation billions will “retain and reinvigorate” the CEFC. “We are promoting innovation and new economic opportunities, enhancing our productivity, protecting our environment and reducing emissions to tackle climate change.”

So Aussie taxpayers will be funding his $1 billion CEIF established out of more CEFC’s billions over the next 10 years. “Smart and cutting edge”, apparently.

Cosmos Bob Brown would be proud. Former treasurer Joe Hockey described it rightly as a “giant $10 billion slush fund”.

Canberra wastes billions and billions of our taxes like this every year. They ignore the massive national debt. So don’t encourage them.

The legislation to abolish the CEFC has been twice rejected by the Senate. It was Abbott’s second double-dissolution trigger after the Senate failed to pass his first budget, but Abbott was a woos and paid for his woosness.

The taxpayer billions will go to pay for more foreign Chinese wind farms. Since it started operations in July 2013, the CEFC has contracted climate change spends of more than $900 million into Greenie projects.

According to the Clean Energy Council, in 2014, Australia’s wind farms, mainly made in China, number 866 wind turbines spread across 71 wind farms, with many more wind farms in the pipeline.