Australia dumbly has all its economic eggs in a China basket case. Then came the Tianjin WorkCover Fireball and then yesterday, Black Monday, August 24, 2015.

|

Communist China is Turd World by any standard.

Communist China is Turd World by any standard.

|

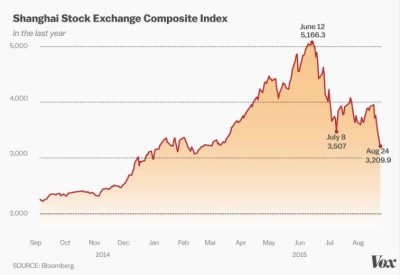

Chinese state (Communist Party) news agency Xinhua dubbed the crash China’s “Black Monday”, saying it was the worst fall since the Asian financial crisis of the late 1990s. China’s key Shanghai composite index saw losses of as much as 9 per cent, about as much as is possible given that each stock can only fall to a daily limit of 10 per cent, before closing 8.5 per cent lower.

Hundreds of billions were wiped off the world’s financial markets, as Chinese rout sends shares tumbling in Europe, Asia and the US.

- The US stock market has suffered its biggest sell-off in four years. The Dow Jones ended the day down 588 points, having shed more than 1,000 points in early trading.

- The S&P 500 and Nasdaq are both in correction territory tonight, down 10% on their recent peaks.

- In London, almost £74bn was wiped off the value of the FTSE 100 index, in a rout led by mining giants.

- European stock markets suffered their worst days trading since 2011.

- The selloff began in Asia 19 hours ago, where Australia’s market suffered its biggest fall since 2009 and Japan’s Nikkei slumped over 4%.

- But China was the worst hit, with the Shanghai composite index dropping 8,5% in the biggest selloff since 2007.

The Australian share market has suffered its worst one-day fall in four years, shedding more than 4 per cent and $64 billion in value after Chinese stocks plunged again.

Communist China’s economic sink hole

Communist China’s economic sink hole

Damage Control is just delaying tactics

Communist China Crowd Control Economics

Communist China Crowd Control Economics

China saved Western bank crisis in 2009, but now China’s economic growth fraud is exposed.

The China tide has turned.

Red Monkey no relevant (肏你祖宗十八代)

Red Monkey no relevant (肏你祖宗十八代)

Monday’s falls were no one-off, with a 4.2 per cent drop in Shanghai on Friday after a key index showed Chinese manufacturing had its sharpest contraction last month in more than six years.

Around the region, Tokyo’s Nikkei closed down 4.6 per cent and Hong Kong’s Hang Seng was off 5 per cent by 5:00pm.

The local market was a sea of red throughout the day, with CMC Markets chief strategist Michael McCarthy saying it was “carnage out there”.

“The sellers are here in numbers and they’re pushing the market lower on high volumes, suggesting there’s a lot of commitment from the sellers in the market today.”

Around 1.3 billion shares in companies on the All Ordinaries index changed hands. Australia’s major banks are all down heavily.

Wall Street opened sharply lower on Monday off the back of China’s losses, with the Dow Jones Industrial Average plummeting more than 1,000 points. The Dow has never lost more than 800 points in one day. The Dow dropped 5.6 per cent in early trade and Wall Street’s benchmark S&P 500 lost 4.65 per cent in early trade.

Similar falls were seen in Europe, with London’s FTSE hitting its lowest level in almost three years, down 5.8 per cent by mid-afternoon.

The Euro Stoxx volatility index rose 14 points to its highest level since November 2011 — more evidence of investor unease.

Crude oil plummeted to its lowest price since 2009, with the West Texas Index dropping below $40.

There is clearly some panic selling occurring and there is little in the way of technical support below the current market price.

Yes we have 7% growth economy – even if driven by empty ghost cities

Yes we have 7% growth economy – even if driven by empty ghost cities

China’s pretense at being a ‘Western’ economy

China’s pretense at being a ‘Western’ economy