Fat Cat Banks are fat because they’re greedy, especially the bank bosses with all their long banking luncheons.

Australian’s bank bash because the big banks deserve it. They are CommBank, ANZ, Westpac, NAB and Macquarie big banks.

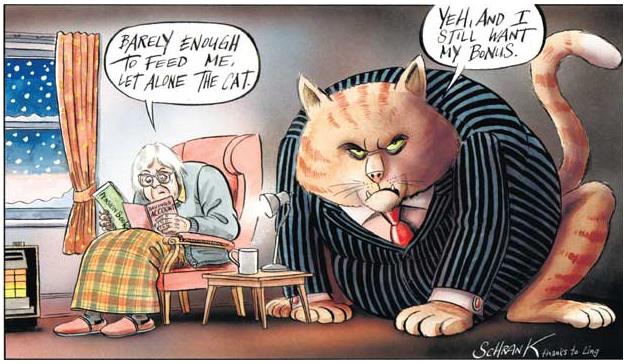

They increase lending rates to gouge profit. They make obscene profits. They pay their bosses aristocratic zillions. They shut down rural branches because they only care about rich cities. They flog credit cards to struggling Aussies. They engage dodgy financial planning fraudsters. They employ traders to collude in market rate manipulation. Their traders indulge in a a culture of sex, drugs and alcohol. They expose depositors wealth to foreign risk. They know Canberra will bail them out with taxpayer wealth. They employ foreigners on 457 visas ahead of Australians. They lose retiree savings then get the big lawyers in. They gang up on the banking watchdog ASIC. They foreclose on loyal farmers in times of flood and drought. They colluded amongst each other. Then every week they indulge in long lunches to chew over their banking fat.

So sell your bank stocks, the banks are on the nose and set to take a dive as shareholders will have to accept share price collapses and lower dividends.

The big four banks have collectively raked in a whopping $98 million since they hit both owner occupiers and investors with out-of-cycle rate hikes and more are expected to come. That means they have up-rated when the Reserve Bank of Australia hasn’t. And they do it in collusion.

Despite the Reserve Bank has kept the cash rate on hold at 1.5 per cent where it has sat since March, but that hasn’t deterred the banks lifting rates and putting more financial pressure on borrowers.

- Westpac has raked in an estimated $50 million in extra interest revenue since it hiked its rates earlier this year

- This is followed by ANZ ($20.6 million)

- National Australia Bank ($18.9 million)

- Commonwealth Bank, which includes Bankwest, at ($8.3 million.)

Smaller banks like Macquarie, Citibank and Adelaide Bank have followed suit to maintain obscene profits and executive bonuses.

Fat Cat Bank Stories

In late 2009, the Australian Wheat Board sold its Landmark Financial Services agricultural loans business to the ANZ Bank with then a loan book to farmers of $2.4 billion, $300 million in deposits, and 100,000 customers – mainly Aussie farmers. At the time, ANZ Bank CEO Mike Smith said the deal was consistent with ANZ’s strategy to become a super regional bank and a leader in agribusiness financial services in Australasia.

“The Australian agricultural sector is well placed to benefit from growth in global population and food demand over the next 10 years, particularly in Asia,” Mr Smith said in a statement. ANZ Bank emailed Landmark clients: “Landmark and ANZ will be working together to keep you informed of any changes'”.

In 2010, with Australia stuck in the grip of a rural financial crisis and many farmers also drought-stricken, the ANZ Bank shamefully started foreclosing on hundreds of rural properties forcing farmers off the land,most of whom had never missed a mortgage payment before the Global Financial Crisis.

With slumped property prices, some rural families also faced a situation where their debt was higher than the value of their farms. The ANZ Bank just auto-devalued farmers land with no discussion about Landmarks original terms and conditions flexible to farmers. Then the bank unconscionably called in the full loans payable within weeks.

It was corporate bully boy tactics from its Queens Street highrise HQ in Melbourne and in a subsequent parliamentary enquiry the ANZ Bank admitted to victimising farmers and overcharging fees during the transition from Landmark to ANZ. But in the process it forced many farming families to the wall and to suicide.

In Western Australia, Rod Culleton’s family called their sheep and wheat farm in Williams home for 20 years, but soon after the ANZ takeover they defaulted on their 15-year loan and were forced off the property.

“We were never in default, because under our loan agreement our cash flow was strong and we could meet our payments monthly. We were right on top of our true position with our business,” Mr Culleton said.

Farmers in positions of default to ANZ, were “held at gunpoint” after receivers were sent in. “Ten [police] came to my place that day [the receivers came in 2013]. “At Bruce Dixon’s it was caught on TV. There were four police with their pistols on us and there were SWAT teams up in the bush, and we were held at gunpoint that day, quite horrific really.”

No wonder Rod went into politics. Pity he got misdirected to join Pauline Hanson’s phony party.

Queensland cane and cattle farmer Brett Fallon of the Whitsunday region had a Landmark loan of $3.5 million, but within a year of buying Landmark, ANZ in 2010 demanded he repay the loan.

Over the next three years Fallon sold assets and all the proceeds [$3.7 million] were paid to the ANZ. Fallon then attended the Ingham branch of the ANZ in May 2013 and was told his outstanding loan was $4 million, and his cattle and crops belonged to someone else.

Fallon had no more funds left. He defaulted, so ANZ sent in the receivers with armed police. Fallon was distraught, forced into a corner with nowhere to go. Fallon tipped 15 litres of petrol over his head and set himself on fire. He survived in a coma for six months, but has missing fingers and maimed hands, so permanently disabled.

Fallon has said that a lot of people could not attend the parliamentary enquiry because they had taken their own lives. He echoed calls for a Royal Commission into banking practice and the establishment of a nationalised Rural Development Bank, to give a break to farmers who had seen their land devalued.

In 2012, ANZ Bank fat cat boss Mike Smith sacked over a thousand of its workers then took a $1 million butler-serviced luxury cruise all-expenses-paid with his two hundred top executives. A further $750,000 was spent flying the execs to board the “world-class” cruise liner in Singapore. On return five days later he outsourced the banks backroom jobs to India and the Philippines.

In 2014, the Commonwealth Bank’s insurance division, CommInsure, unscrupulously denied bona fide insurance claims from hundreds of Ordinary Australian policy holders, just to save money. The management directed fraud include rejecting claims by heart attack victim James Kessel and doctoring his medical file to avoid paying the claim. The fraud rejected the claim by Evan Pashalis (37) diagnosed with terminally ill with leukaemia with two doctors finding he was unlikely to live more than 12 months and a third gave him a 30 per cent chance of living a year.

The fraud also rejected Nicholas Bishop’s terminal lung condition who was given 12 months to live.

Even CommInsure employee Helen Polydoropoulos who became diagnosed with multiple sclerosis in 2011 and advised by the bank’s chief medical adviser, Dr Colin Johnston, to claim for “total and permanent disability”, had her claim rejected by CommInsure insurers – her own colleagues!

Then CommInsure’s former chief medical officer Dr Koh blew the whistle on CommInsure’s entrenched culture of dishonest and unethical practices aimed at avoiding payouts to sick and dying people. He exposed unethical and unscrupulous behaviour including claimants files going missing, and doctors being illegally pressured to change their medical opinion if it did not suit CommInsure’s “claims strategy”.

“They were quite blatant about it … ‘can you please change it or delete it so that we can go to someone else to provide another opinion that’s more favourable…the medical team asked us to either delete opinions that we have given or to change an opinion that we have actually given because it ran counter to a claim strategy.”

Dr Koh was sacked by CommInsure in August 2015 after being accused of sending internal documents to his personal email

Between 2007 and 2001, Commonwealth Bank employees Bill Jordanou and accountant Robert Zaia committed almost 100 fraud and deception offences totalling $76 million to fund personal property developments. They siphoned off millions from the accounts of Commonwealth Bank clients, without their consent, or knowledge. The Commonwealth Bank failed to alert police of the fraud allegations which involved both Mr Jordanou and Mr Zaia until 2011, despite knowing about them as early as February 2007.

Another Commonwealth Bank client, Nick Fotopoulos, a Melbourne property developer, has launched a civil action against the bank for it stealing $5 million from his account.

Mildura residents Jim and Debbie Barker, were the first to raise suspicions when two large sums, amounting to $26,000 were taken from Ms Barker’s bank account. The couple reported that a forged document, falsely stating Mr Barker’s annual salary as $343,000 (Mr Barker’s actual salary was $80,000) to obtain a $1.5 million loan.

The bank agreed to return the $26,000 due to the unauthorised withdrawal, but the Barkers were eventually forced out of their homes due to Commonwealth bank refusing to accept that the loan documents were forgeries.

Some reports indicate that a number of mobile lenders also played a vital role in the scam. However, at this time, none of them have been charged with any criminal offences.

Australia’s main banks remain over-exposed internationally and this was played out during the US Subprime Mortgage crisis which drove the 2008 Global Financial Crisis. The major banks’ results for financial year 2015-16 show the bank’s preferred measure of cash earnings slipped a staggering 25% from $30.6 billion to $22.7 billion in earnings according to internationally accepted accounting rules.

NAB was the big culprit in that department due to its foreign exposure in Britain with its loss-making UK banking business and its life insurance division. NAB lost $4 billion on its US mortgage company HomeSide in the early noughties, and $1 billion torched in toxic US mortgage assets in the GFC. This followed the NAB’s rogue trader scandal in which four bonus-hungry traders falsified records to cover up mounting losses totalling $360 million.

Between 2006 and 2009, Westpac Bank lent a retired Gold Coast truck driver, Gary Hughes, seven loans totalling more than $2.6 million to invest in a property development scheme which later collapsed.

The loans contained misleading information known to the former Westpac loans manager David St Pierre at Westpac’s Pacific Fair branch.

Mr Hughes was one of a dozen pensioners who have lost up to $13 million from signing off on loans from St Pierre.

Mr Hughes alleged he was between 61 and 64 years, was “a truck driver on modest income”, had no superannuation or alternative savings and the bank applied an income of $71,000 when his tax return showed $54,133. Westpac had “failed to act as a diligent and prudent lenders” in advancing him the fifth, six and seventh loans.

Mr Hughes had “trusted the manager” and signed off on loan agreements “without reading those documents” and expected he would be advised his residence was used as security. But Westpac had not misled Mr Hughes and it was clear from the loan documents that “the residence was security for the fourth loan”.

Mr Hughes got crook in January 2010 with a bowel cancer.

“I haven’t worked for five years. I’m plugging on. I have to go to Brisbane to have a couple of operations. I watch my spending. I have to pay these bastards back $560 a month. That’s what the bank want from me for the rest of my life. It’s only an interest payment. If I die, this bloody bank will sell my unit and take what’s owing to me.”

David St Pierre (46) pleaded guilty to three counts of dishonestly using his position to gain advantage for fraudulently loaning $13 million to elderly pensioners and.has since been sentenced by Southport District Court and jailed for a paltry six months.

He also set up a multi-million dollar Ponzi scheme that fell apart after a 30-year mortgage was granted to a 98-year-old dementia patient.

In 2014, National Australia Bank (NAB) suspended, terminated or ensured resignations of 31 NAB financial planners and aligned advisers over the past two years due to conflicts of interest, inappropriate advice, inappropriate practices or serious repeat compliance breaches. Another six, it says, had been sacked from Meritum, a NAB-owned advice network that has 110 planners on its books.

Anyone can be a financial planner when you work for a bank – no background checks

In the past five years, there had been cases where NAB planners had forged clients’ signatures or manipulated clients’ files in attempts at covering up poor compliance. The bad behaviour was detected not by the bank’s internal controls, but instead came to light through complaints from clients or queries by regulators.

This follows revelations of severe misconduct by Commonwealth Bank financial planners, a systematic cover-up by management, and low-ball offers of compensation to complaining customers. Brought to light by a Commonwealth Bank whistleblower, Jeff Morris, the crisis has triggered a bipartisan Senate inquiry, which has called for a royal commission into Australia’s banks.

NAB’s financial advice arm housed within NAB Wealth, a massive division incorporating MLC, includes the bank’s life insurance and superannuation businesses, stockbrokers JBWere, planning firms Meritum, Garvan and Godfrey Pembroke, and the NAB-branded financial planning network. The ACCC has allowed this monolith to grow to dominate the industry.

The leaked documents have shone a light on multiple problems within NAB Wealth – a business, it turns out, that has been plagued by cost and time overruns on multiple, critical projects; a sudden and recent spike in internal breaches reported to regulators; and multiple highly rated internal risks.

“The deep-seated problems at NAB confirm that it is not just CBA and not just financial planning that is in dire need of the scrutiny only a royal commission can provide.” says Mr Morris.

The practice of handing out bonuses and holding staff and executives to account has seen the head of the NAB intensely questioned over the bank’s decision-making. NAB’s head of wealth Andrew Hagger overcharged 220,000 corporate superannuation accounts totalling $36.5 million if you can get away with it.

Mr Hagger received 120% of his bonus in 2013 despite the fraud and he’s still senior at NAB.